- donedeal’s Investment Index – a data-driven gatekeeper and decision-making proprietary tool – is the result of long experience in investment decision-making processes as well as academic research;

- It aims at neutralising investment biases;

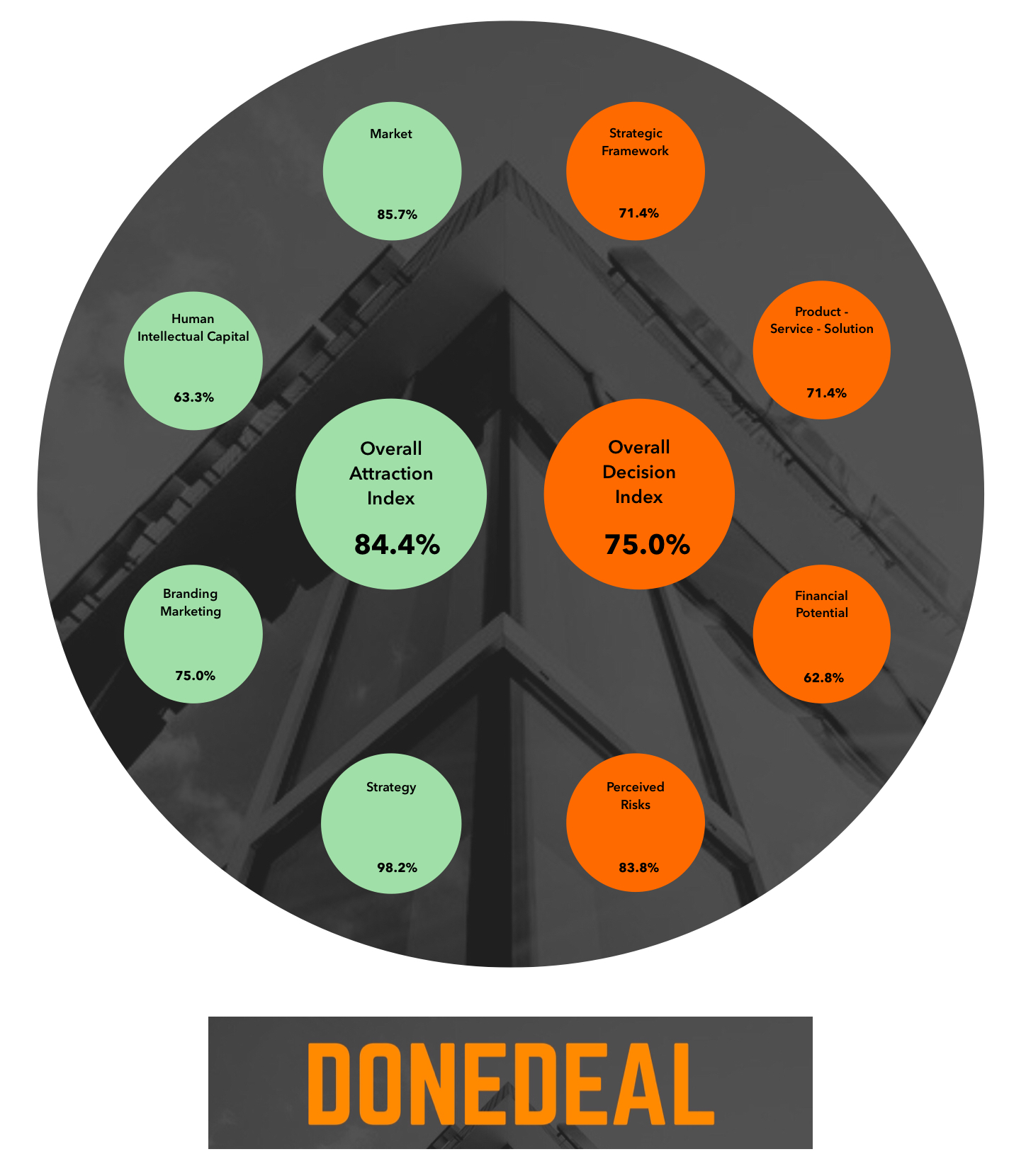

- donedeal’s Investment Index calculates objective indices about an investment’s attractiveness, its fit with the investor’s profile, and to what extent a positive decision can be made on the investment;

- Steering the discovery and due diligence processes, the Index enables how companies can be prepared to become more attractive investment opportunities and gives guidance to fine-tuning those opportunities into successful investments;

- donedeal’s Investment Index creates a context to compare the attractiveness of investment opportunities and their potential road to success, and thus offers transparency, consistency, credibility, and quality to the investment process

Client focus

- Family offices, private offices, and smaller advisory firms;

- Online corporate finance brokers and platforms;

- Angel networks and angel investors;

- Crowdfunding platforms;

- Investment boutiques;